Trading the Charts for Monday, August 21st

In order to read this entire newsletter you’ll need to become a paid subscriber by clicking the button below. Paid subscribers get full access to my trading portfolio (up ~62% YTD), daily watchlists, daily activity (buys, sells, entry prices, stop losses, performance), daily webcasts/recordings and my options portfolio.

I also run a Stocktwits rooms where I post about my investment portfolio (up ~90% YTD)with full access to all holdings, performance, daily activity, market commentary, quarterly earnings analysis, daily webcasts and more.

Here are my deep dive newsletters…

Good morning and Happy Monday,

It’s a big week for earnings but that’s mostly because NVDA reports on Wednesday afternoon which could set the stage for how tech stocks perform over the next couple months.

Here are two of my recent posts about NVDA and where estimates are for FY2024 through FY2028.

https://twitter.com/JonahLupton/status/1693369407832035371?s=20

https://twitter.com/JonahLupton/status/1692611236951683329?s=20

NVDA is priced for perfection; in order to move the stock higher post-earnings I think they need to report $11.5+ billion for Q2 and give guidance of $12.8+ billion for Q3.

We have some minor macro data releases this week but the most important event will be Powell’s speech at Jackson Hole on Friday, it was his speech last year at this event that caused the markets to selloff into the October lows.

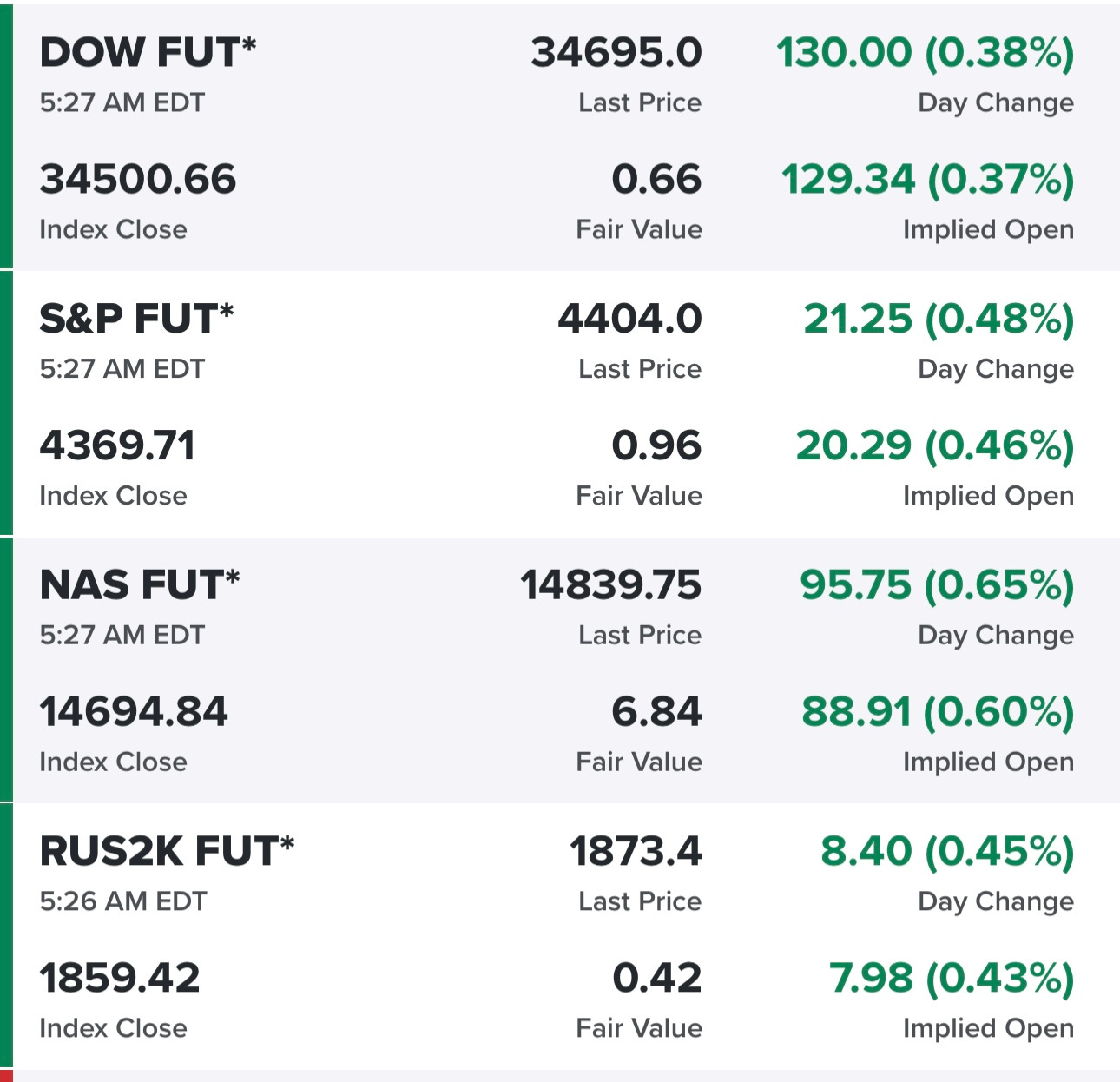

Futures looking good this morning, hopefully they stay this way into the open…

Yields up slightly this morning, 10Y at 4.29% will make it hard for stocks to sustain any rally…

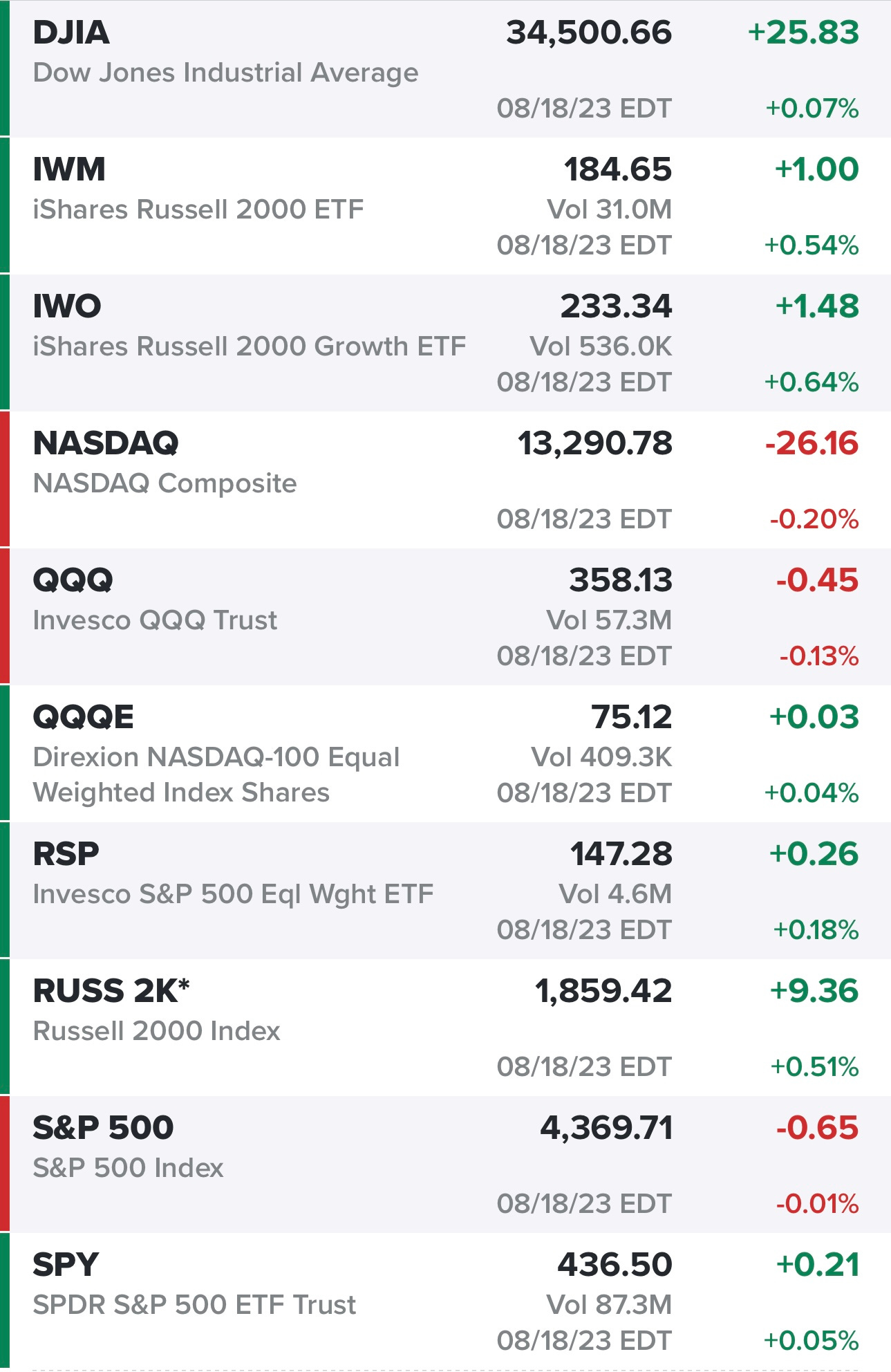

The indexes were mixed on Friday but bounced big off their morning lows which makes me think we’ve seen the correction and now we might be able to have a decent week…

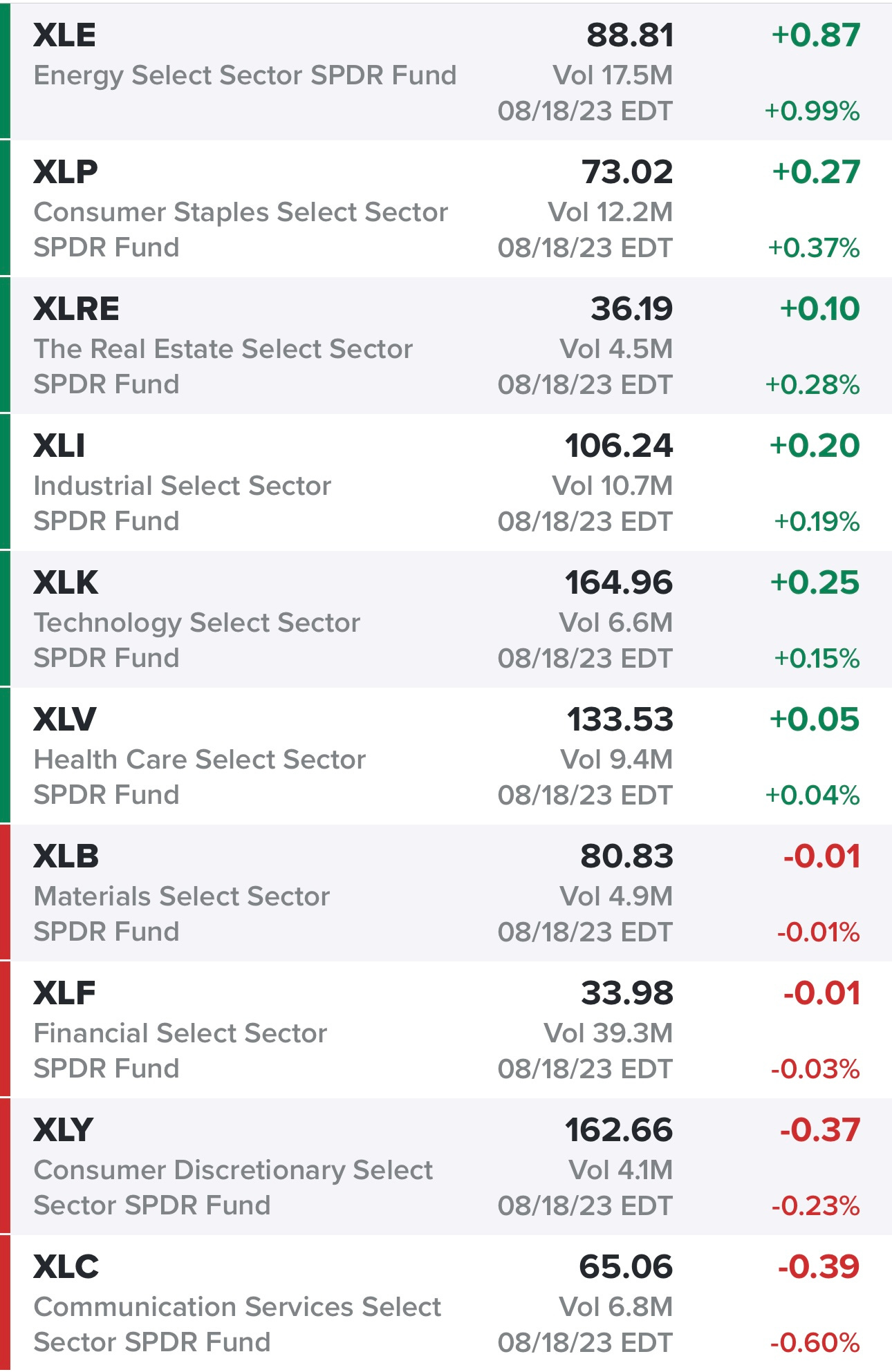

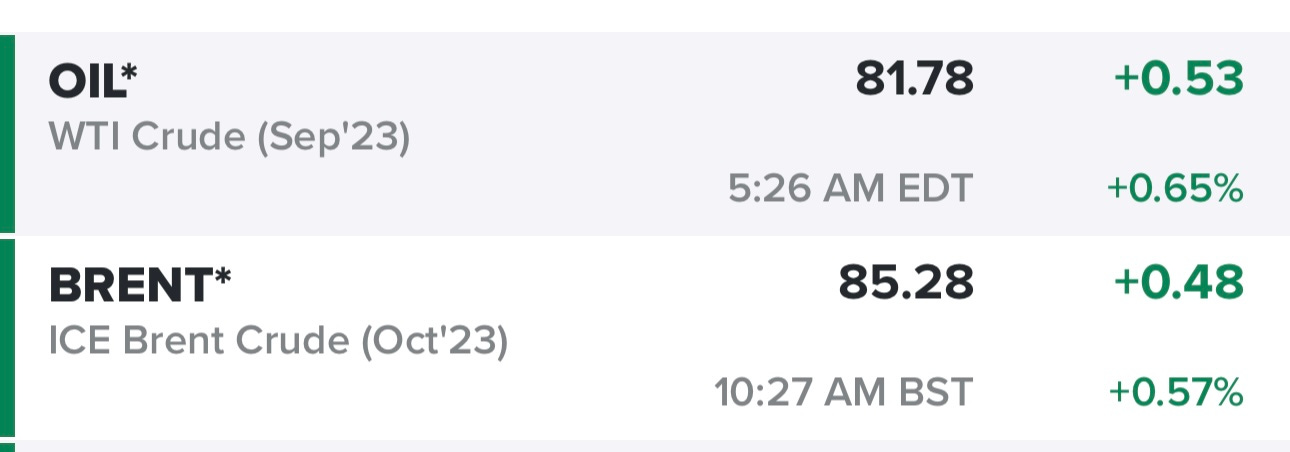

Energy is still the strongest sector, as I went through my morning charts it was very clear that energy stocks still look the best with most of them still above their 21/23d ema…

SPY with a nice bounce off the lows on Friday after a -5.7% correction, let’s see if we can get back above the 50d ema by end of week but I suspect Powell on Friday will determine how we close the week, now up +14.1% YTD

QQQ with a nice bounce on Friday after an -8.4% correction, hopefully we see a few days of green, now up +34.5% YTD

IWM with a big bounce on Friday after an -8.4% correction, but then rejected at the 200d sma which it’s pushing up against pre-market, IWM is now up less than +6% YTD which is lagging the SPY by ~8% and the QQQ by ~28%

IWO with a huge bounce on Friday, basically off the 200d sma, now up +8.7% YTD

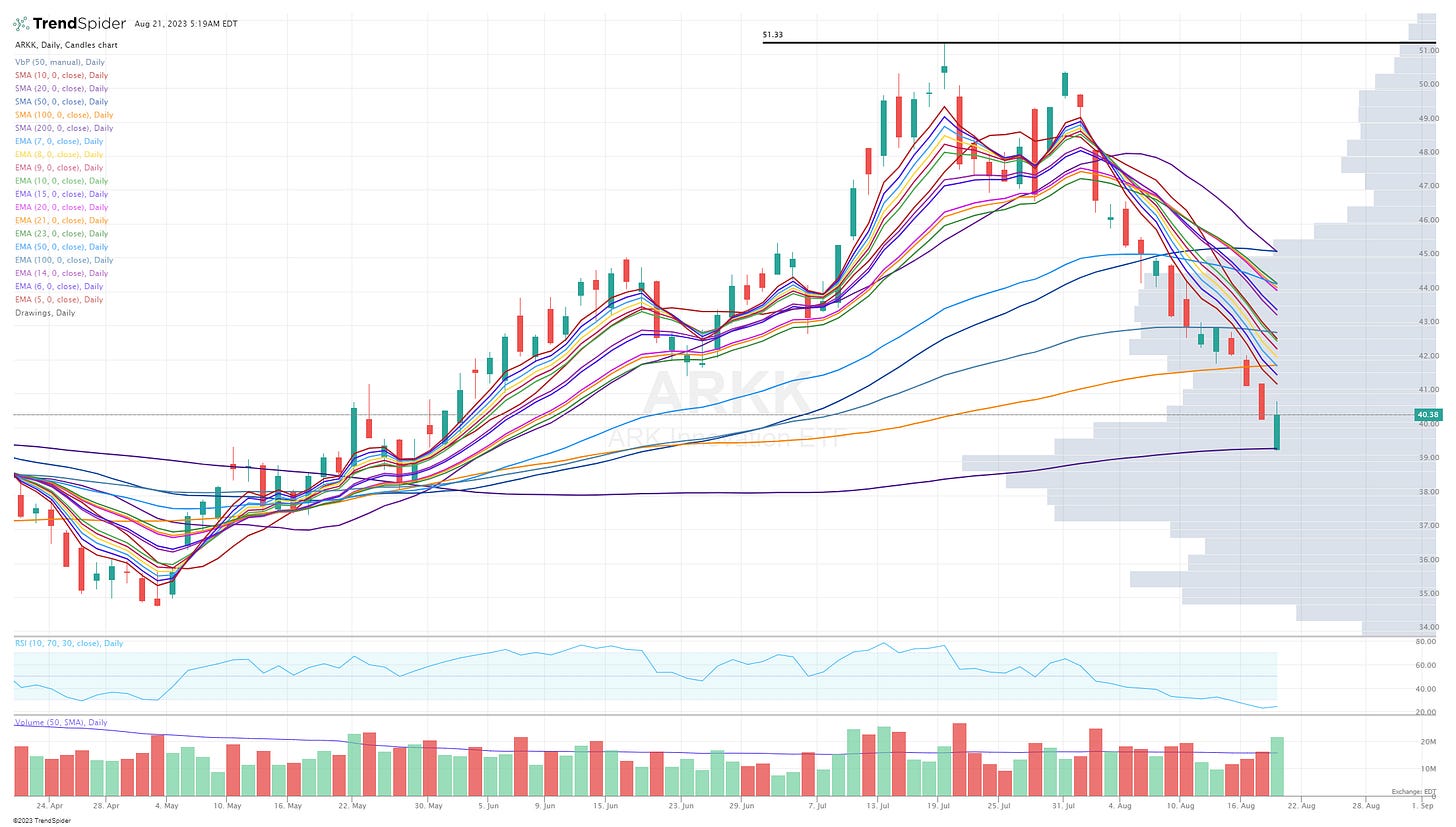

ARKK has been in freefall mode for the past month, dropping more than -23.3% from the July highs before bouncing on Friday at the 200d sma, ARKK is still up +29.2% YTD but obviously gave back a big chunk of it’s 2023 gains the past 4 weeks. I covered my ARK short last Wednesday (a couple days too early) but I’ll stay unhedged for now unless ARKK fails to hold the 200d sma in which I’ll get short again.

Below the paywall is my current trading portfolio including all positions (open & closed), watchlists, entry prices, stop losses and YTD performance and my daily webcasts.