Trading the Charts for Wednesday, August 2nd

In order to read this entire newsletter which includes full access to my trading portfolio (up ~70% YTD), daily watchlist, daily activity (buys, sells, entry prices, stop losses, performance) and my daily webcasts you’ll need to become a paid subscriber by clicking the button below.

I also run a Stocktwits rooms where I post about my investment portfolio (up ~103% YTD and ~1,050% over the past 3-years) with full access to all holdings, performance, daily activity, market commentary, quarterly earnings analysis, daily webcasts and more.

Here are my deep dive newsletters…

Good morning and Happy Wednesday,

Today and tomorrow might be the two biggest days for investors this earnings season (they are for me). Lots of earnings reports after the close yesterday, we should see big gap ups from ELF, FRSH and MTCH with big gap downs from SEDG and EXAS.

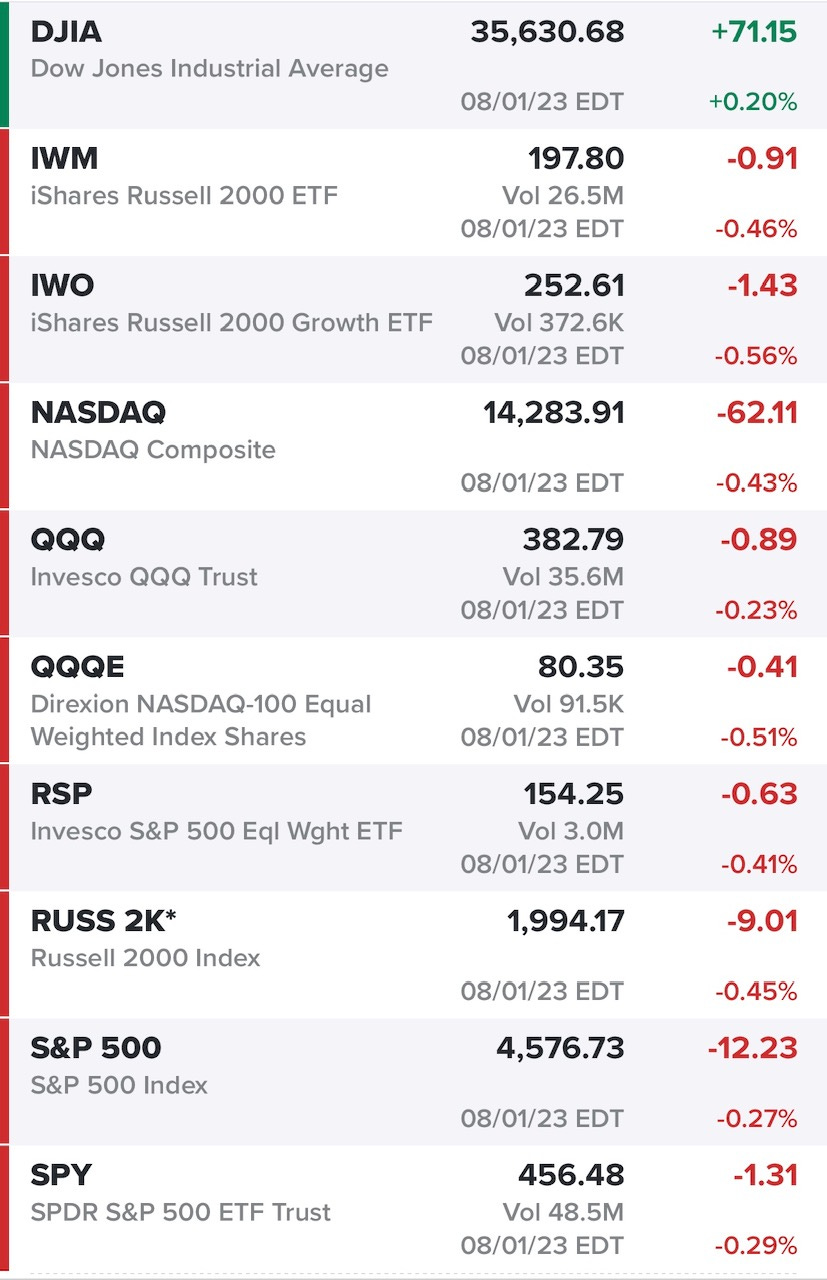

Yesterday morning there was definitely some selling pressure, especially in small/mid caps but then we did see some bounces in the afternoon although all of the indexes (except the Dow Jones) did finish in the red.

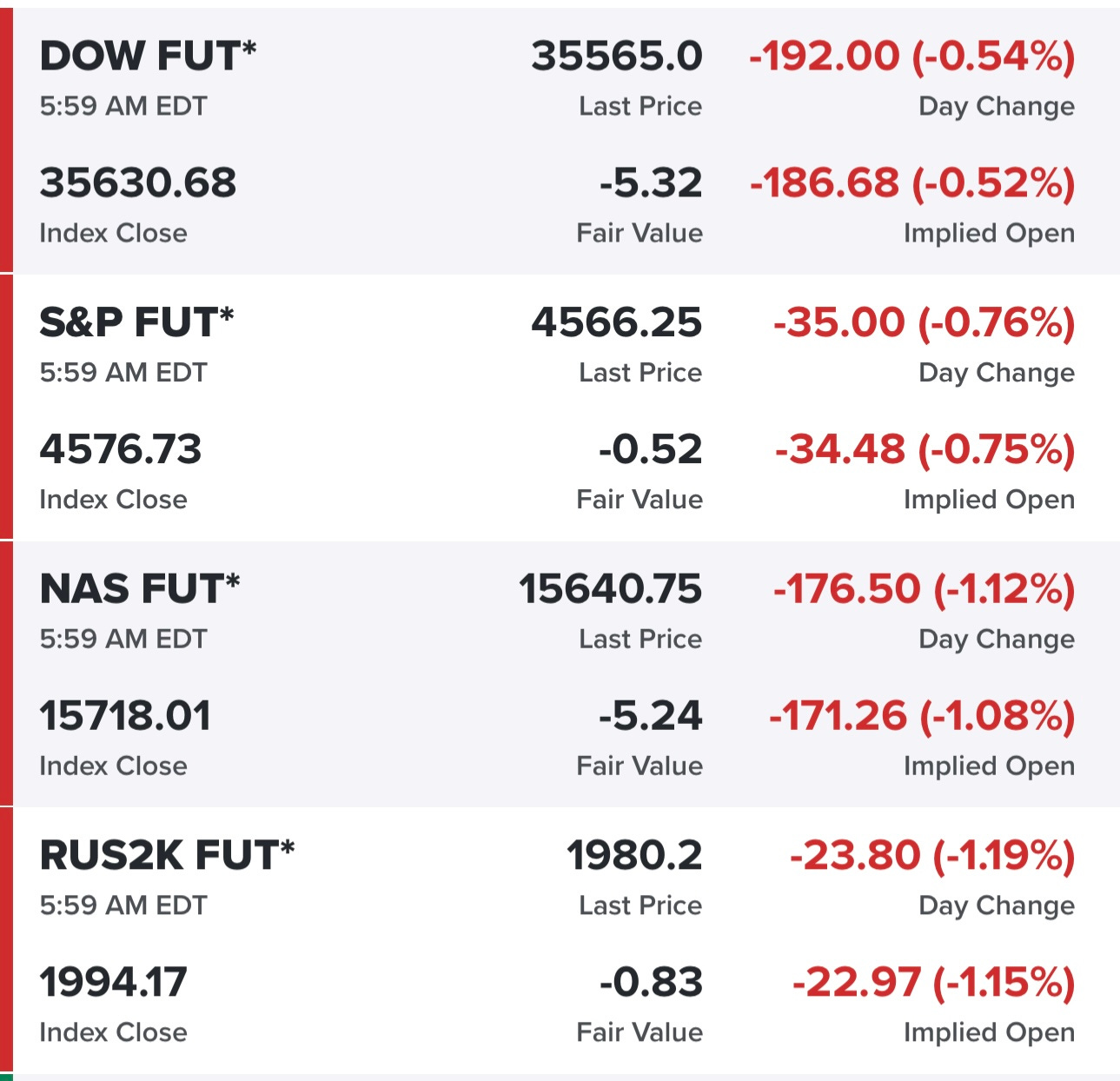

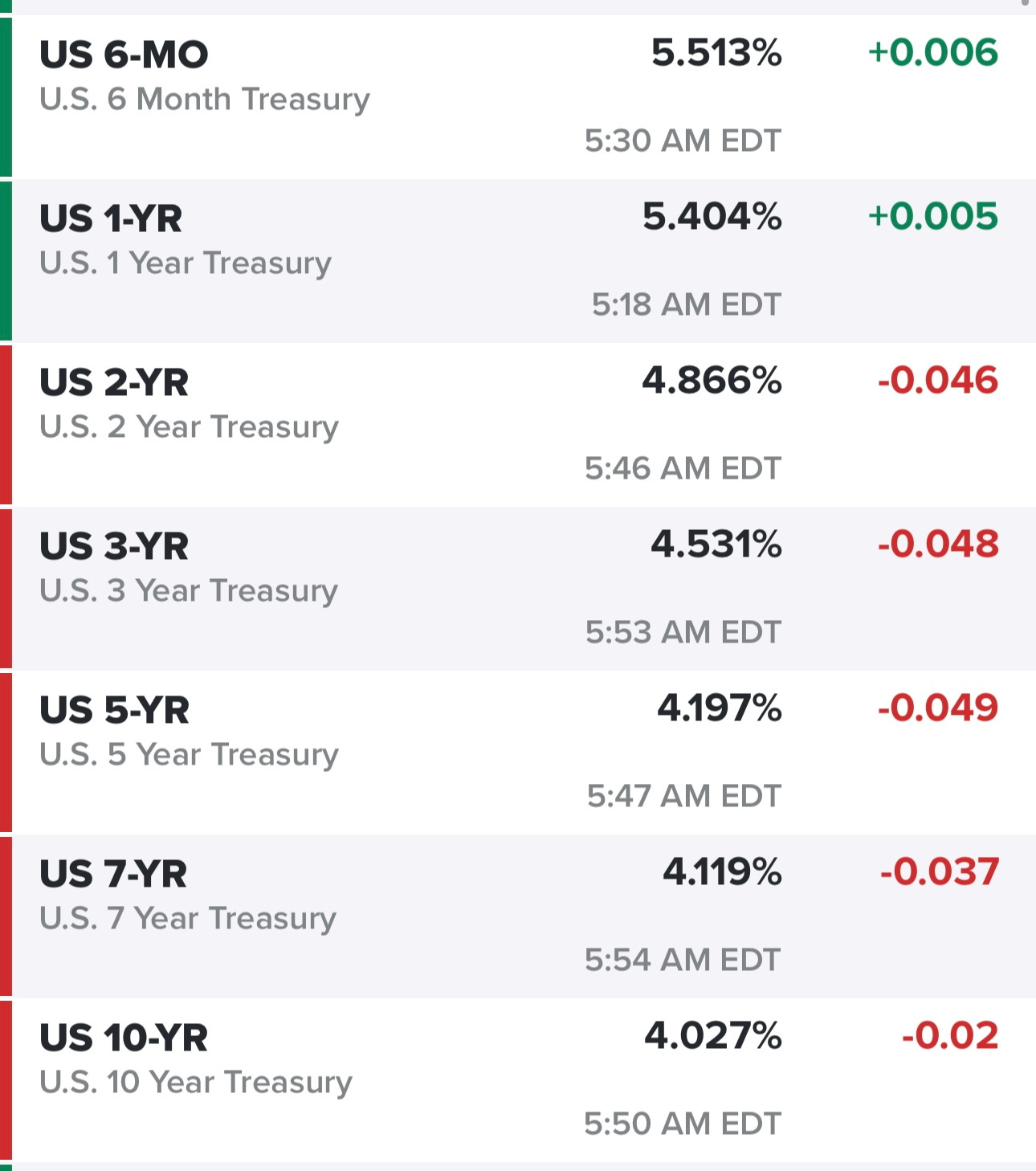

Unfortunately the futures are looking very ugly this morning, not sure if it’s just some broad profit taking ahead of AAPL and AMZN tomorrow or because Fitch downgraded the US government bond rate or maybe because the 10Y treasury is still above 4% or because valuations are not super compelling at current prices.

Yields have been creeping higher for the past few weeks which wasn’t necessarily expected with inflation coming down however the FOMC remains in the “higher for longer” camp and economic growth is still decent with many economists raising their full year GDP forecasts.

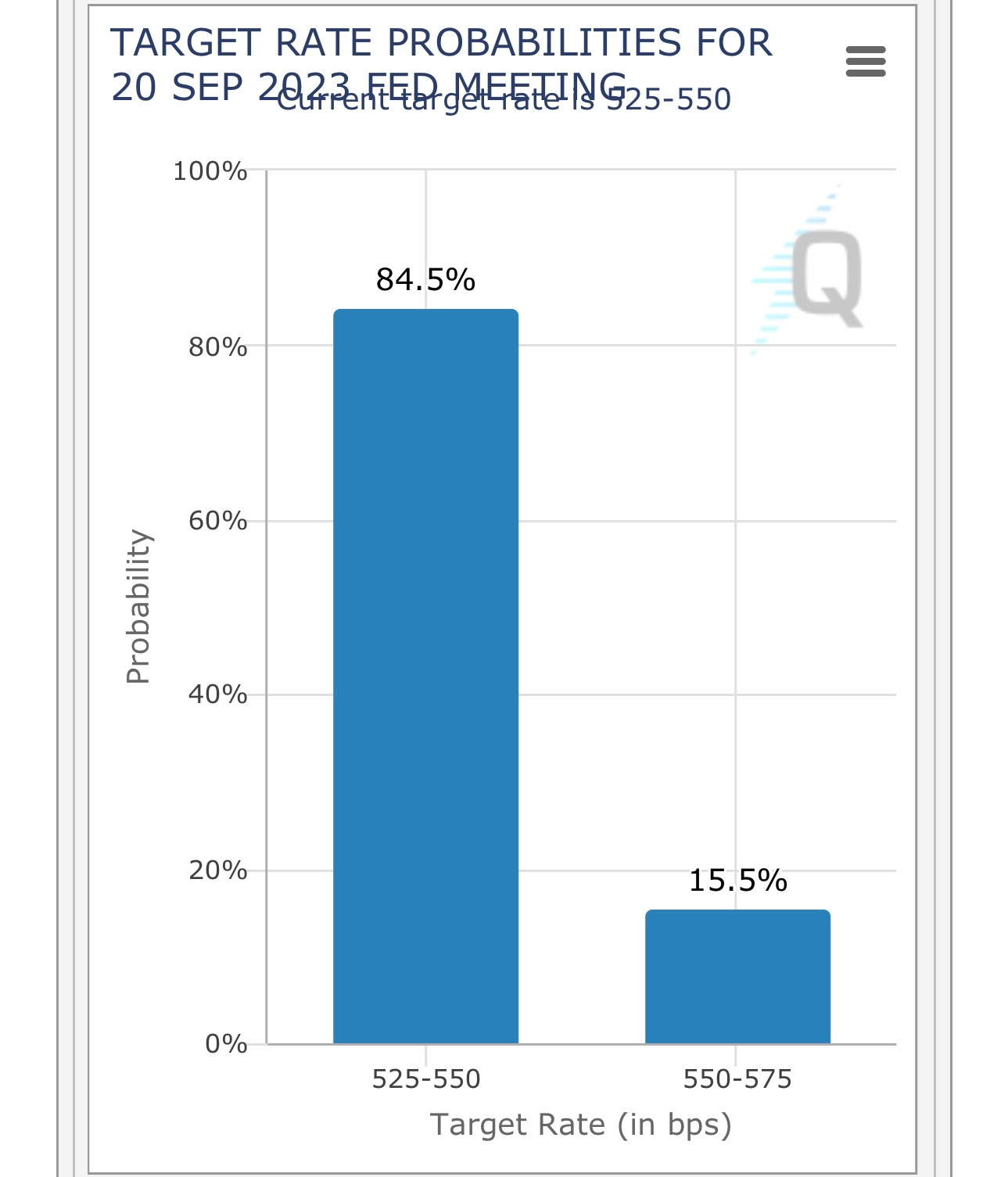

Probability for another FOMC rate hike in September is now down to 15.5% versus 20-25% a week ago.

Oil prices continue to move higher, a few weeks ago the prices were stuck under $70 and now we seem to be settling above $80 which should be good for energy stocks, also why I’ve been increasing my energy exposure (in my trading portfolio) over the past couple weeks

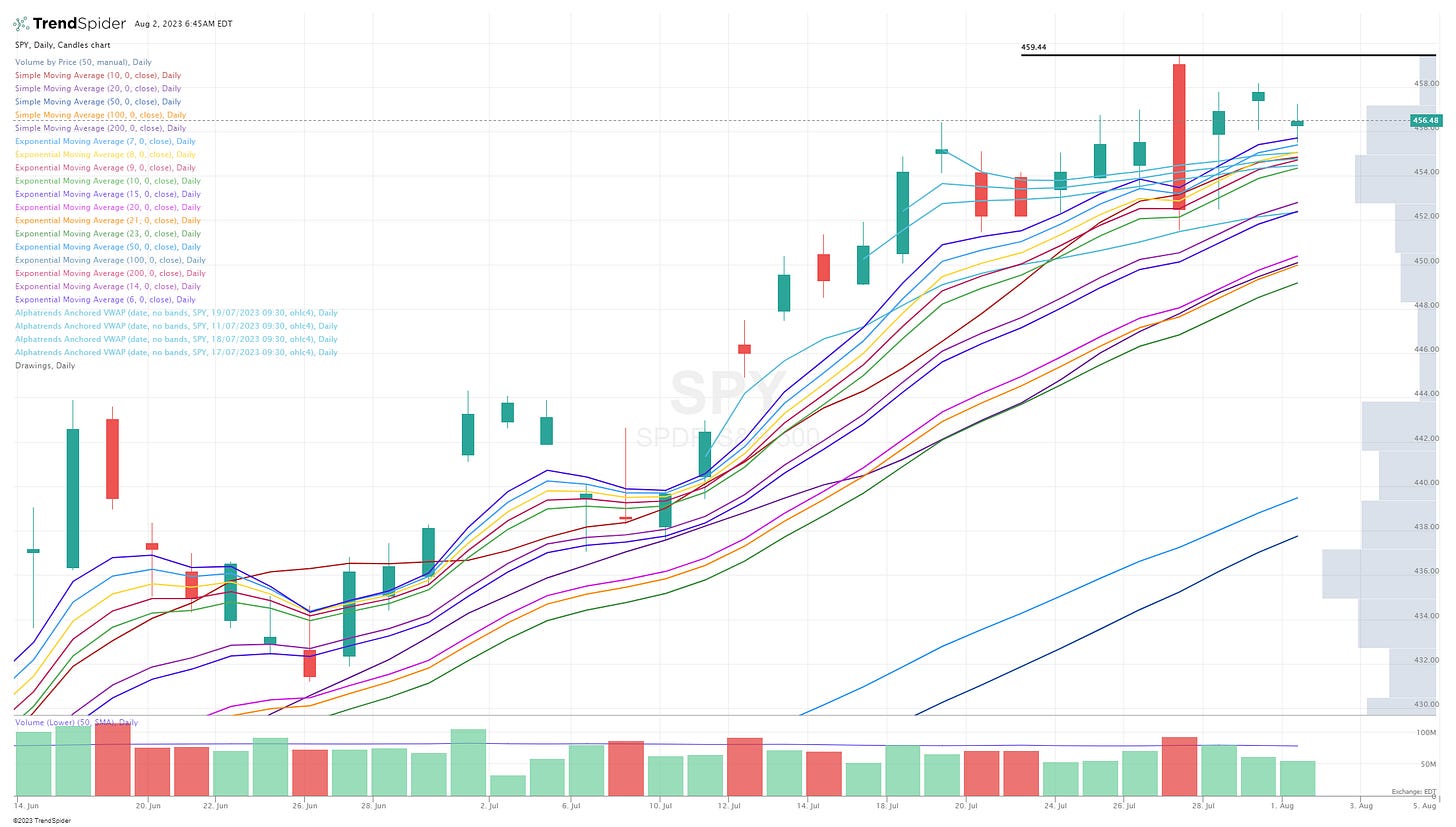

SPY bouncing yesterday at the 6/7d ema, looks like we might test those lows today at the open. There’s a few VWAPs that could provide support but most likely would be bounce off the 10d ema which is approximately 0.46% below yesterday’s close.

RSP slicing through the 10d ema yesterday then bouncing off the VWAP from the July 13th candle, we might slice through that today and test the 14/15d ema which is approx 0.5% below yesterday’s close.

QQQ with a decent bounce yesterday off the 7d ema and the VWAP from recent highs, we could find support today at the 10d ema/sma which is 0.8% below yesterday’s close.

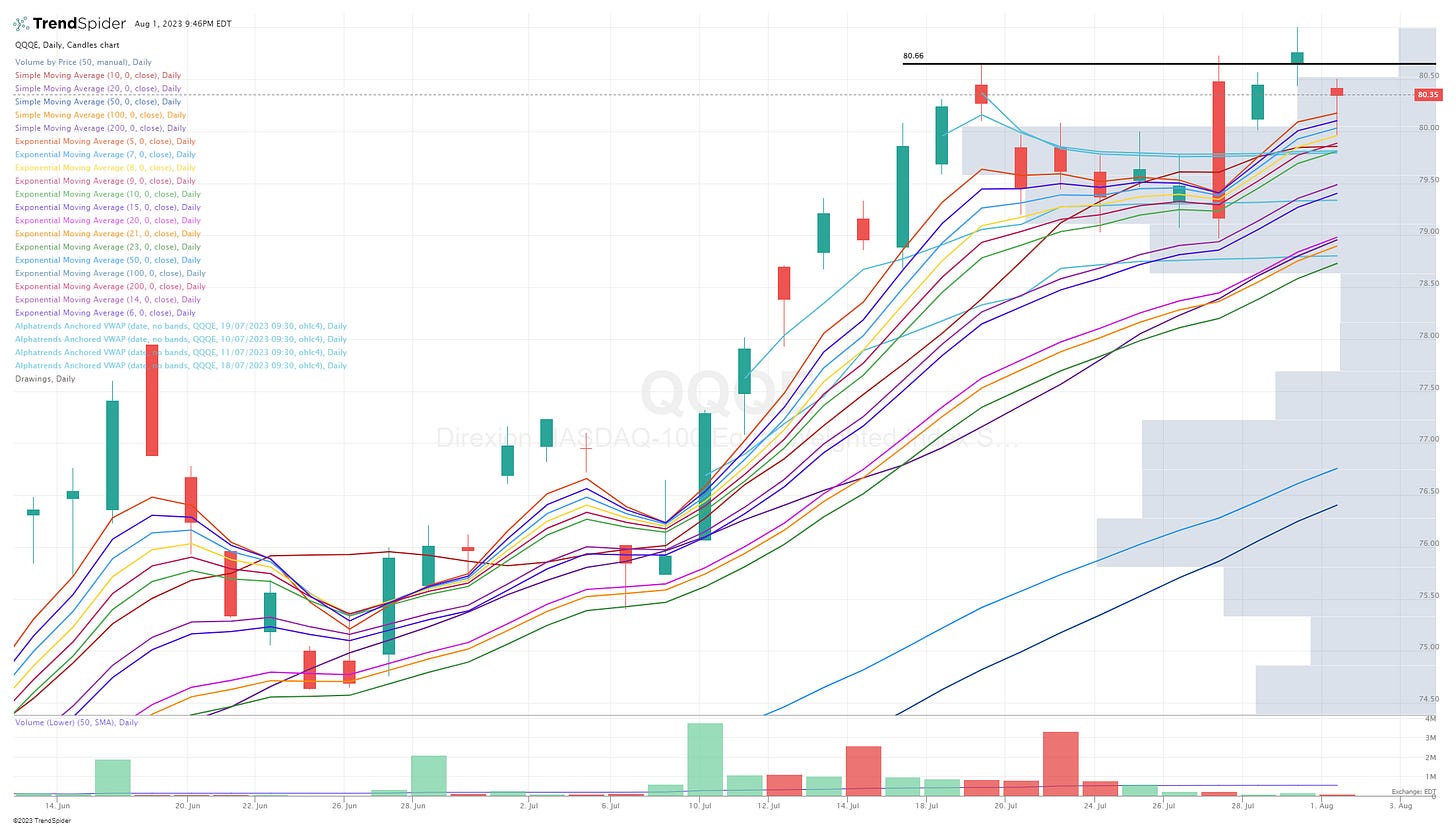

QQQE bouncing off the 8d ema yesterday, today we might test the 10d ema and VWAP from recent highs which is 0.7% below yesterday’s close.

IWM with a strong bounce yesterday off the 9d ema and VWAP from July 19th, we might retest those same levels at the open which is approx 1% below yesterday’s close.

IWO with a big bounce yesterday off the 10d ema, we might retest that level today, fwiw, lots of IWO stocks reporting the next two days.

ARKK with a decent pullback yesterday, was down -3.5% at the lows but did close +1.6% off the lows after bouncing off the 9d ema. ARKK is down 2.1% pre-market so looks like we’ll test the 10d ema/sma at the open.

Below the paywall is my current trading portfolio including all positions (open & closed), entry prices, stop losses and YTD performance plus a link to my daily webcast.