Trading the Charts for Thursday, August 10th

In order to read this entire newsletter which includes full access to my trading portfolio (up ~66% YTD), daily watchlist, daily activity (buys, sells, entry prices, stop losses, performance) and my daily webcasts you’ll need to become a paid subscriber by clicking the button below.

I also run a Stocktwits rooms where I post about my investment portfolio (up ~100% YTD and ~1,000% over the past 3-years) with full access to all holdings, performance, daily activity, market commentary, quarterly earnings analysis, daily webcasts and more.

Here are my deep dive newsletters…

Good morning and Happy Thursday,

Yesterday was another big day for earnings and it feels like the pops and drops are getting bigger which makes it risker to hold stocks into earnings unless you have a larger profit cushion (assuming you are a trader).

If you’re a long-term investor than no single earnings report should scare you however that doesn’t mean you should not re-evaluate your investment thesis after a company reports to determine if the fundamentals still justify the valuation. I sold three stocks from my investment portfolio over the past two weeks because they either gave us a disappointing Q2 report or disappointing guidance or both. I have investment models for all my stocks but once a company starts to miss my estimates it can be enough to get me selling especially when I have 10-15 higher conviction names I’d rather be buying.

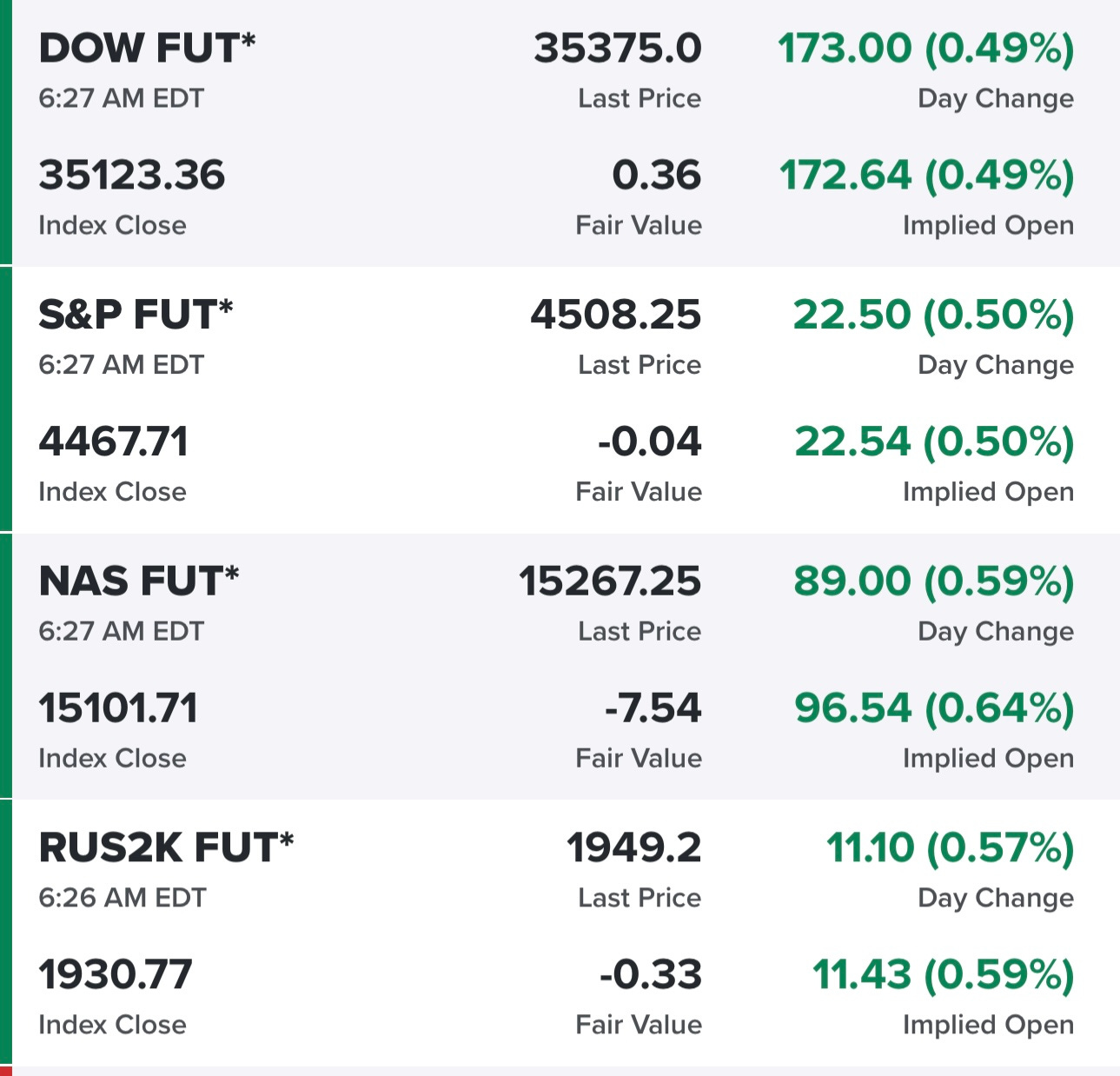

Futures looking good but keep in mind we get July CPI at 8:30am EST so I would not trust the futures yet because they can still swing in either direction. Last July CPI was 0% MoM which means even if we only get 0.2% MoM in today’s report the headline YoY number will still go up. If you’re long this market you should be worried about MoM coming in at 0.3% or higher. For headline CPI the easy comps are over so it will be harder to get headline CPI much lower before year end. There’s a chance we get down to 2.6% YoY by end of year but I would not be surprised if we ended 2023 right at 3.0% YoY. Core CPI doesn’t include food and energy so it didn’t spike up a year ago in the same way or fall as fast so we might still see core coming down YoY in today’s report. We know the FOMC is more focused on core CPI so if that number comes in hot it raises the chances of another rate hike in September and/or November.

Yields are flat this morning ahead of CPI, the 10Y still sitting right on 4%

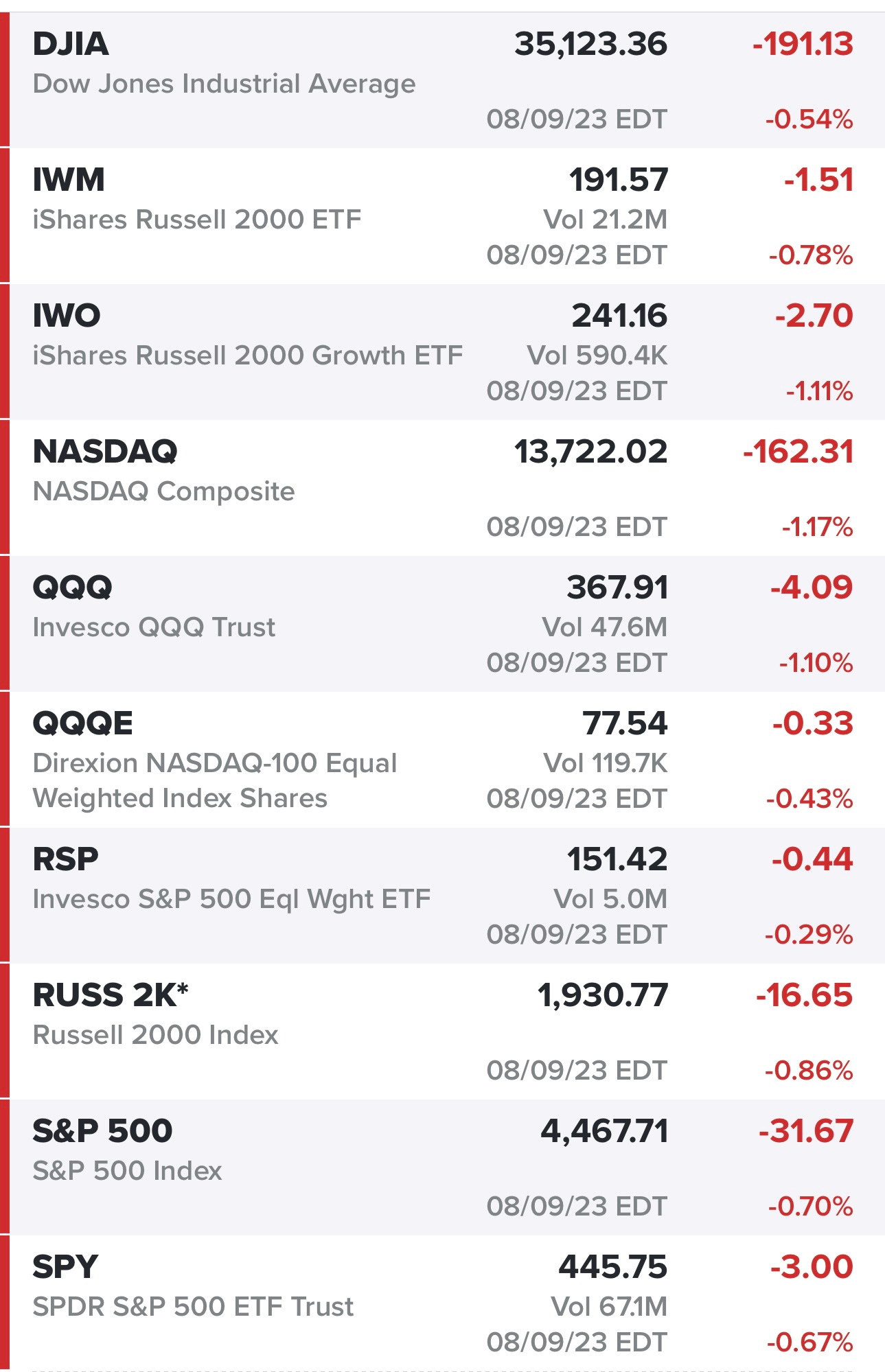

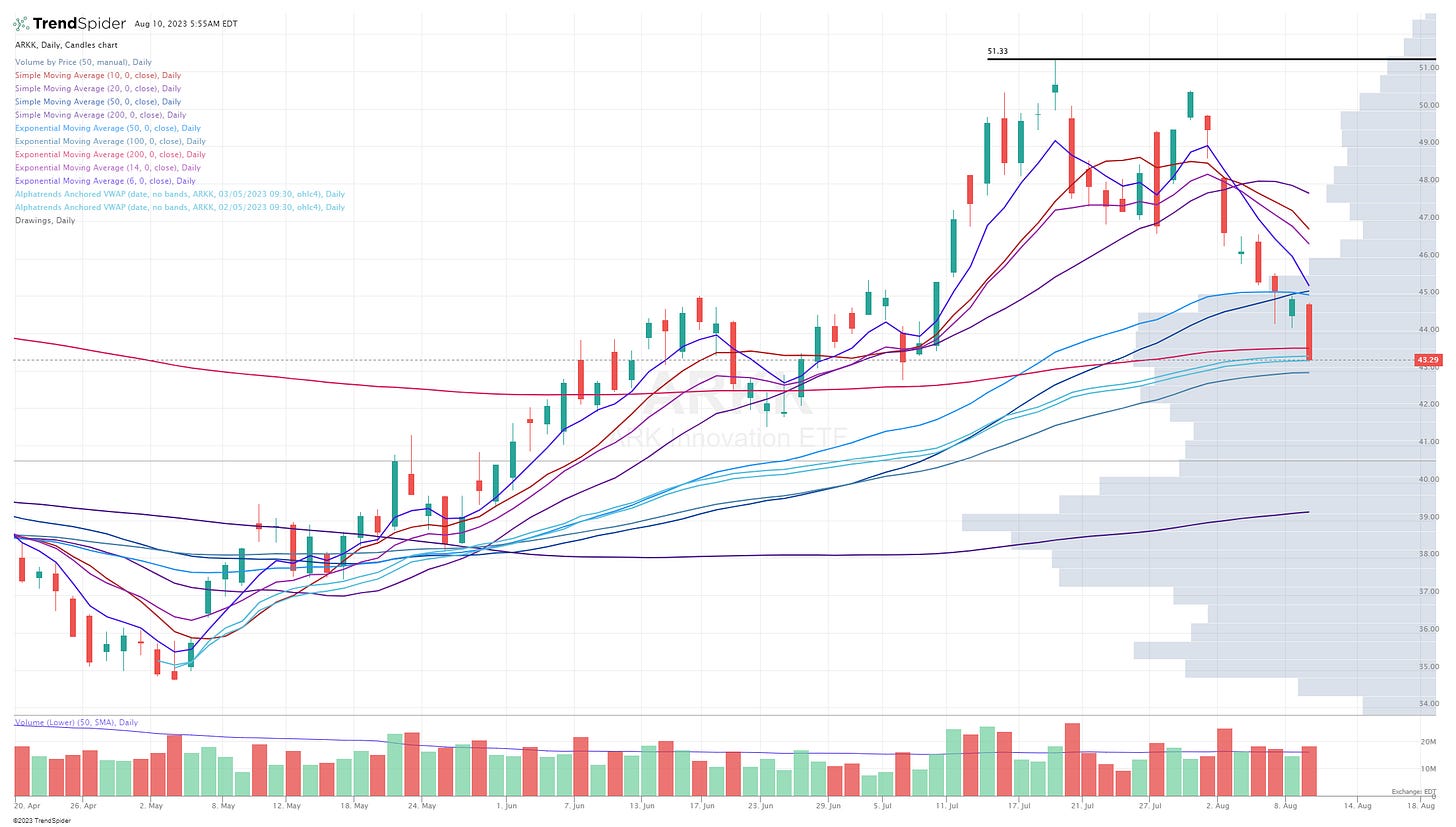

Equities coming off a red day across the board, although most of them did bounce off the lows. I believe IWO was down -1.5% at the lows of the day. I know that ARKK was down at least -3.5% at the lows because I posted a chart on twitter showing where it might find support…

https://twitter.com/JonahLupton/status/1689305422933487616?s=20

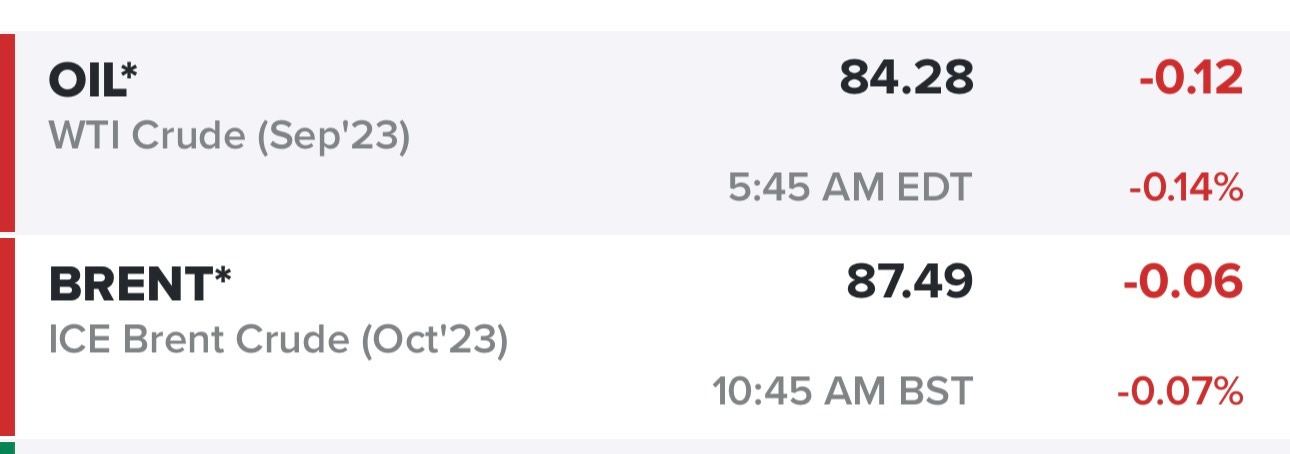

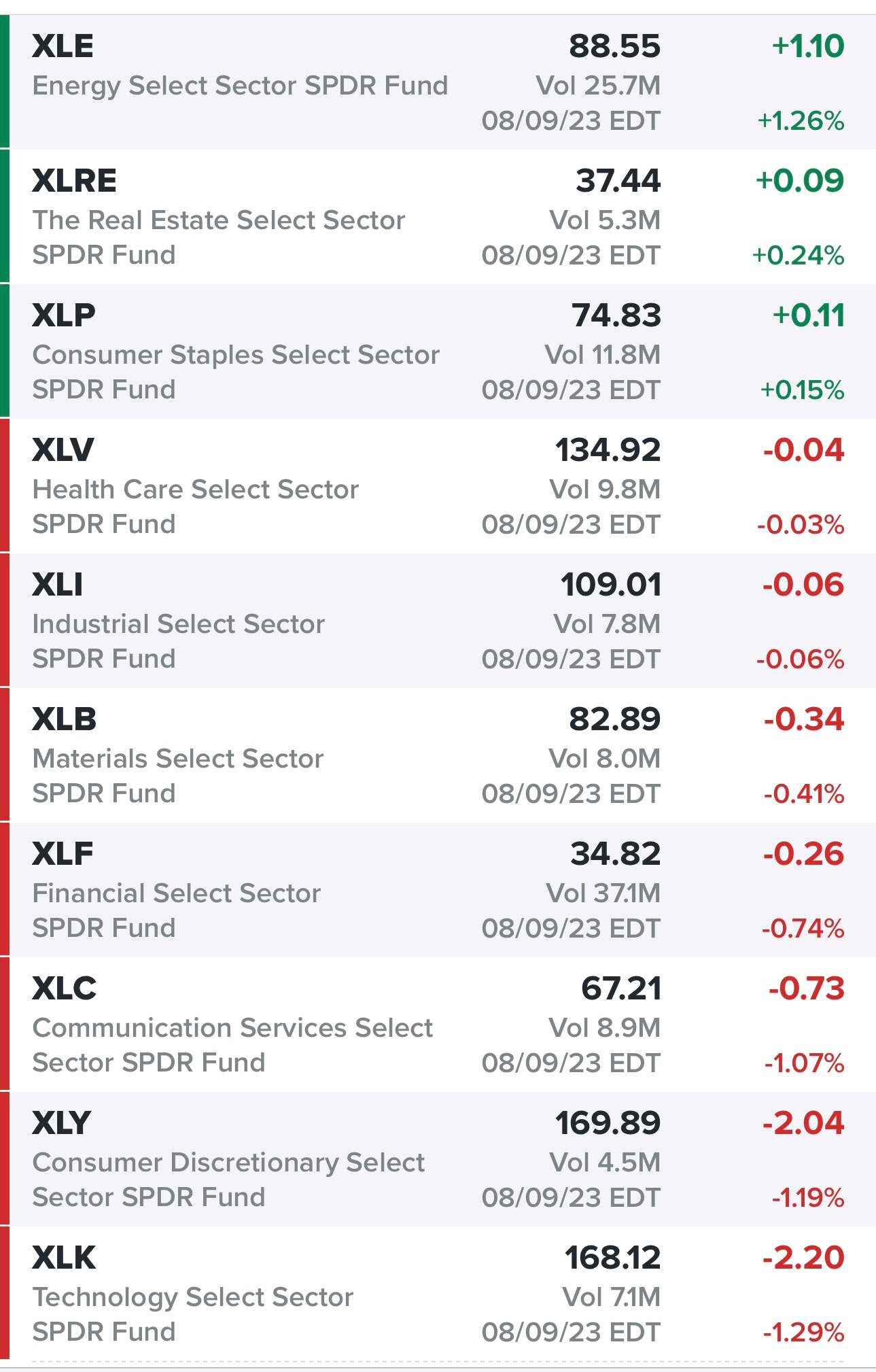

Oil starting to grind higher again, if you don’t have some energy exposure you are making a mistake.

Yesterday was another strong day for energy stocks…

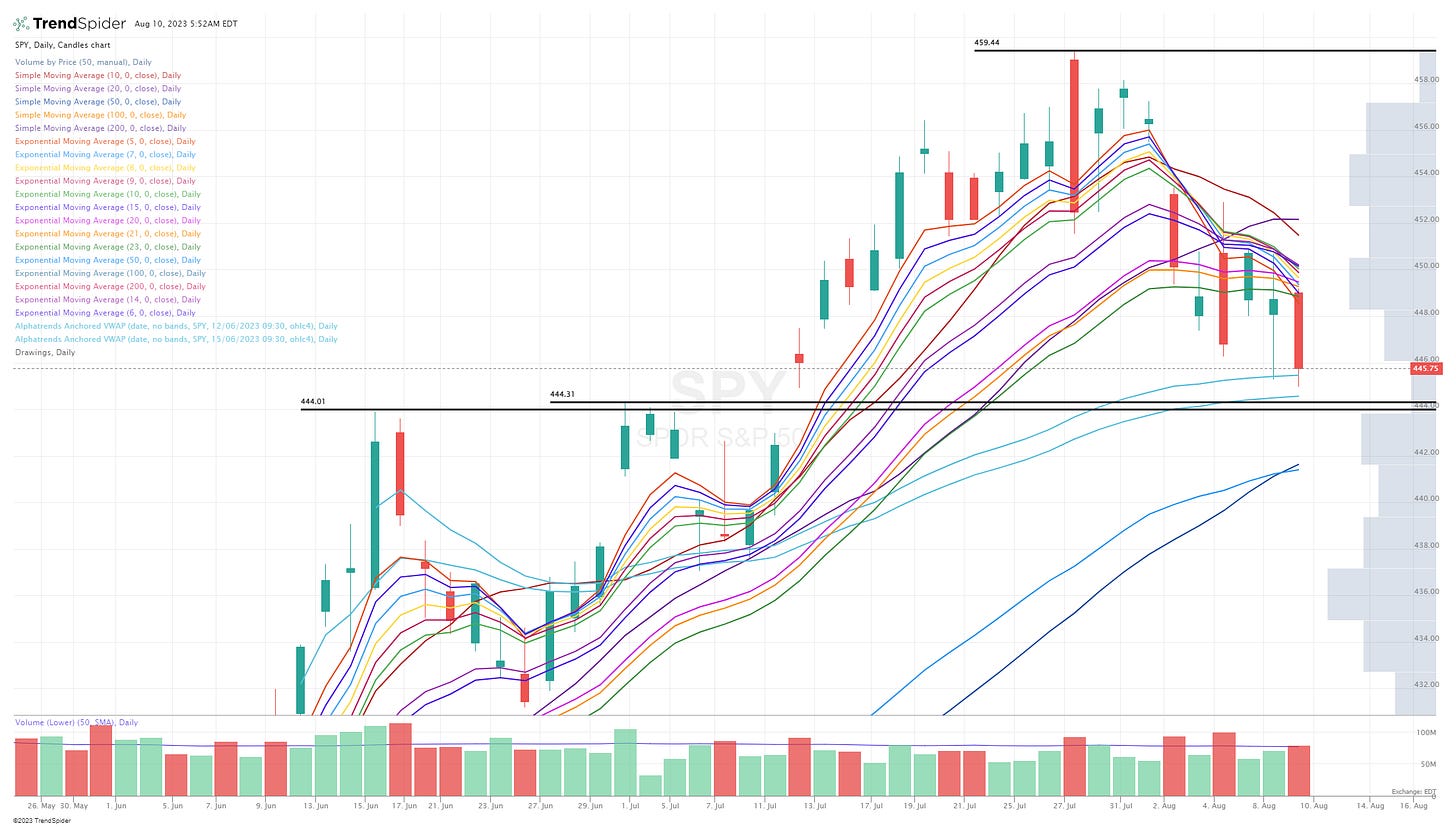

SPY — finding support at the VWAP from the June pivot, if CPI comes in really hot today I think it’s possible if see SPY slice through the 444 pivot and then the 50d ema/sma are definitely in play at 441.50 which is approx 1% lower from yesterday’s close.

RSP — looks similar to SPY, although sitting just above the VWAP from June pivot with the 50d ema right at the 149.86 pivot and the 50d sma just below.

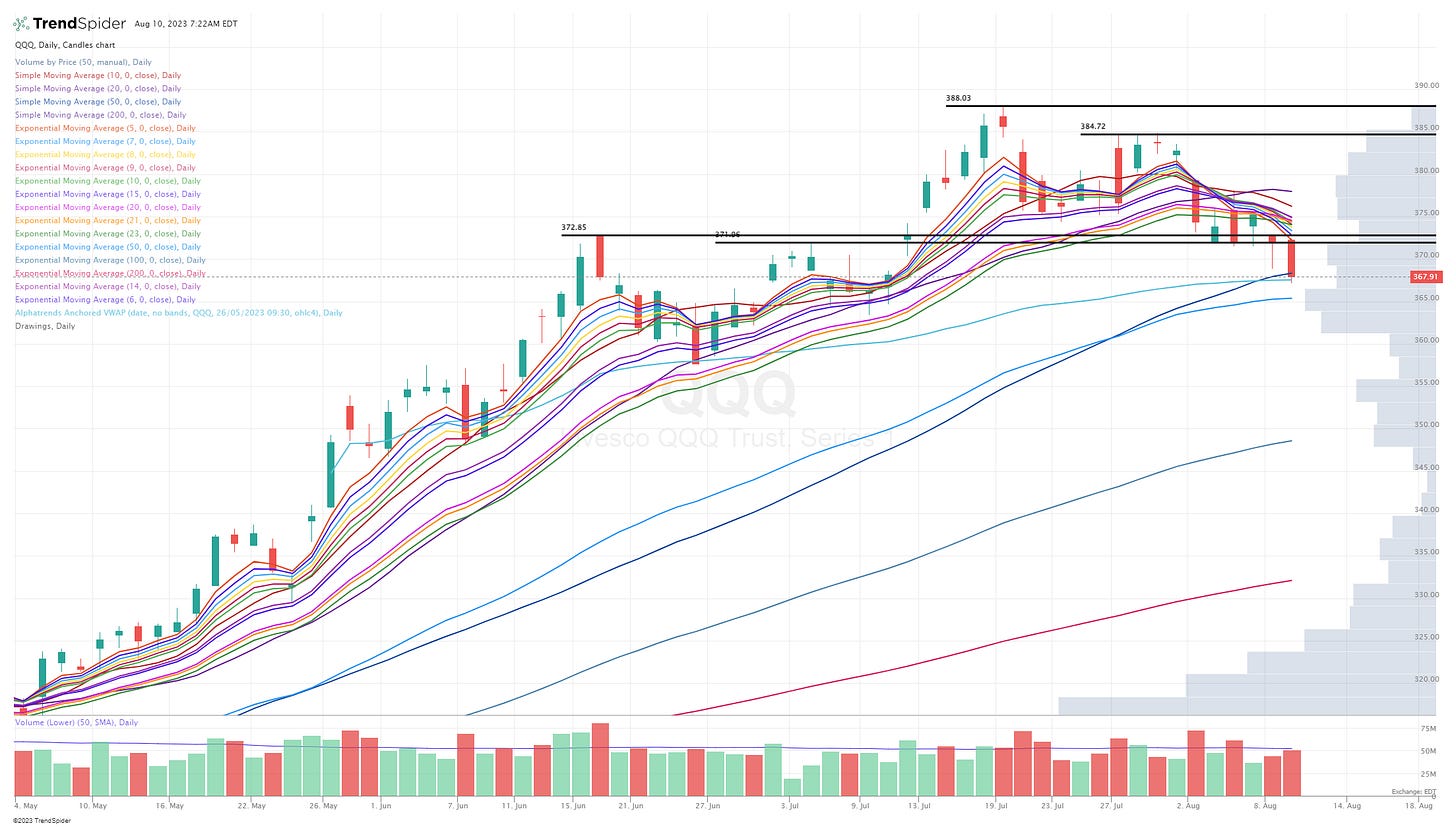

QQQ — ugly candle yesterday, did bounce off the VWAP from that big up day in May, QQQ has now corrected 5% from the recent high, sitting right on the 50d sma as well so the CPI report today will be important. If QQQ slices through 50d ema then I think 357 is the next level for support

QQQE — unable to get back above the 77.94 pivot, sitting just above the 50d sma/ema, QQQE has now corrected 4.3% from the recent high.

IWM — finding support at the VWAP from mid June lows, still above the 189.25 pivot but below the 23d ema, if we get a further pullback today and/or tomorrow I’d look for a bounce off the June pivot and 50d ema

IWO — bouncing off the VWAP from May lows (already sliced through 50d ema/sma)

ARKK — just like IWO, also bouncing off the VWAP the May lows with 100d ema just below (already sliced through 50d ema/sma)

Below the paywall is my current trading portfolio including all positions (open & closed), watchlists, entry prices, stop losses and YTD performance and my daily webcasts.