Trading the Charts for Tuesday, August 1st

I decided to give everyone until 10pm EST tonight to lock in the current rate of this newsletter at $20 per month or $200 per year. Before I go to bed tonight I’m raising the prices to $30 per month or $300 per year. After running this newsletter for the past 4-5 months I’ve realized how much time and effort it takes to review hundreds of charts every day, put together the morning newsletter and then post all of my trades on a spreadsheet for my subscribers. The fact that I’m up 70% YTD in my trading portfolio should be enough proof that I know what I’m doing and my strategy is effective.

I also run a Stocktwits rooms where I post mostly about my investment portfolio (up ~103% YTD and ~1,050% over the past 3-years) with full access to all holdings, performance, daily activity, market commentary, quarterly earnings analysis, daily webcasts and much more.

I’m raising the prices this week (for new members) to my Stocktwits room but you can still lock in the current rates which are $20 per month or $200 per year with a 7-day free trial.

Tonight before I go to bed I’m raising the prices to $30 per month or $300 per year.

Here are my deep dive newsletters

Good morning and Happy Tuesday,

We’re still in the heart of earnings season, overall I think Q2 earnings are trending better than expected but we still have a long ways to go. FWIW, nice earnings from UBER this morning, stock is up 4-5% pre-market (this is a top 3 position for me across both my portfolios). After the close today I’ll be watching AMD, SBUX, DVN, PINS, ELF and SEDG — I don’t own any of them but these are great companies that can move the markets and impact other stocks.

SPY still looking good, above the 5d ema and closing yesterday near the highs of day, still needs to get through 460.00

RSP bouncing off the 6d ema, pushed through previous day highs but could not hold it

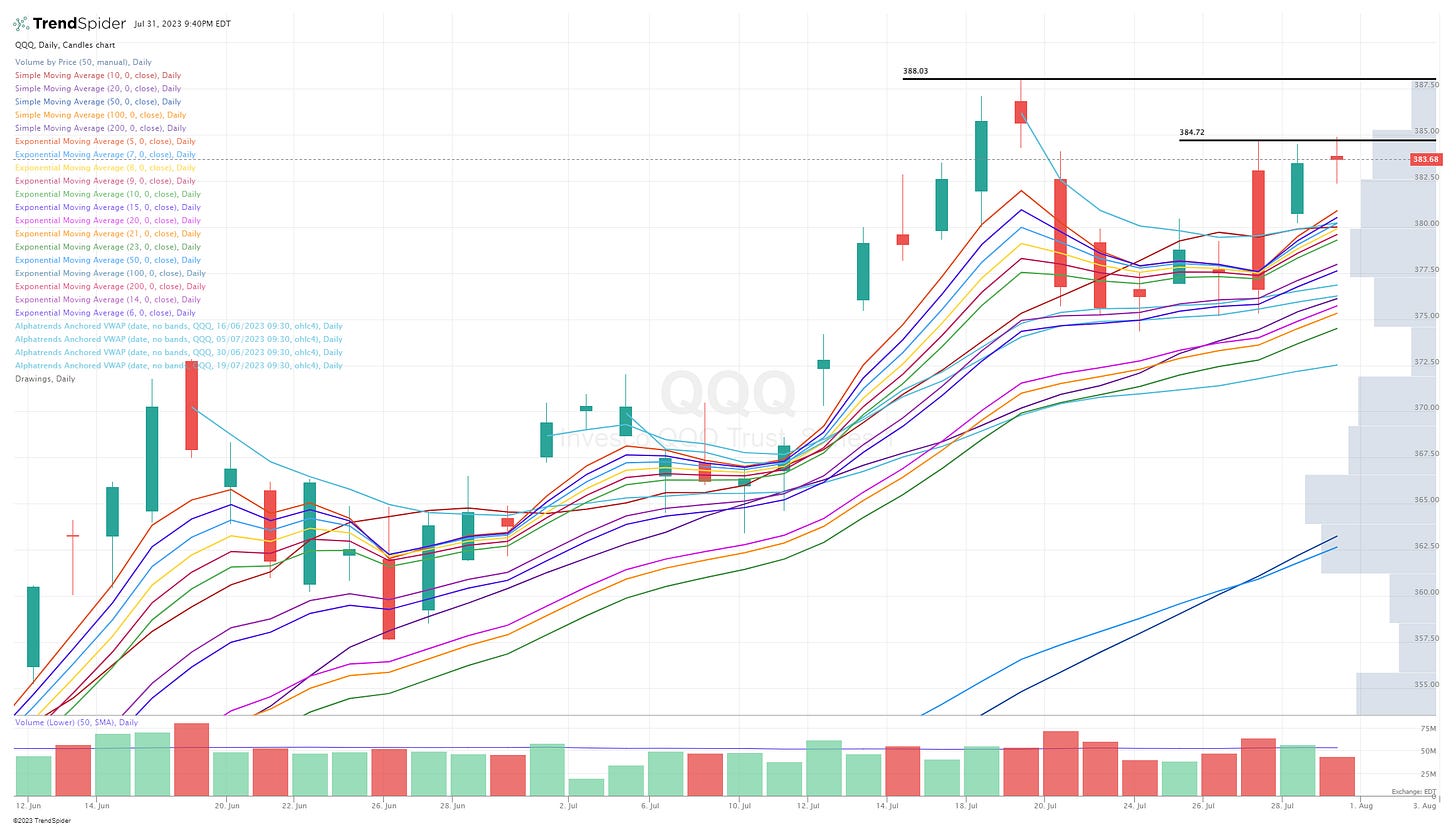

QQQ looking fine but still getting rejected at 384.72

QQQE looking the best of all the indexes right now, pushing through the recent highs and closing above the 80.66 pivot and the highs from last Thursday’s nasty reversal.

IWM also looking really strong, clearly small/mid caps are building some momentum and TBH they look a lot more attractive than large/mega caps. That top line is the February high which could be resistance in the next few days.

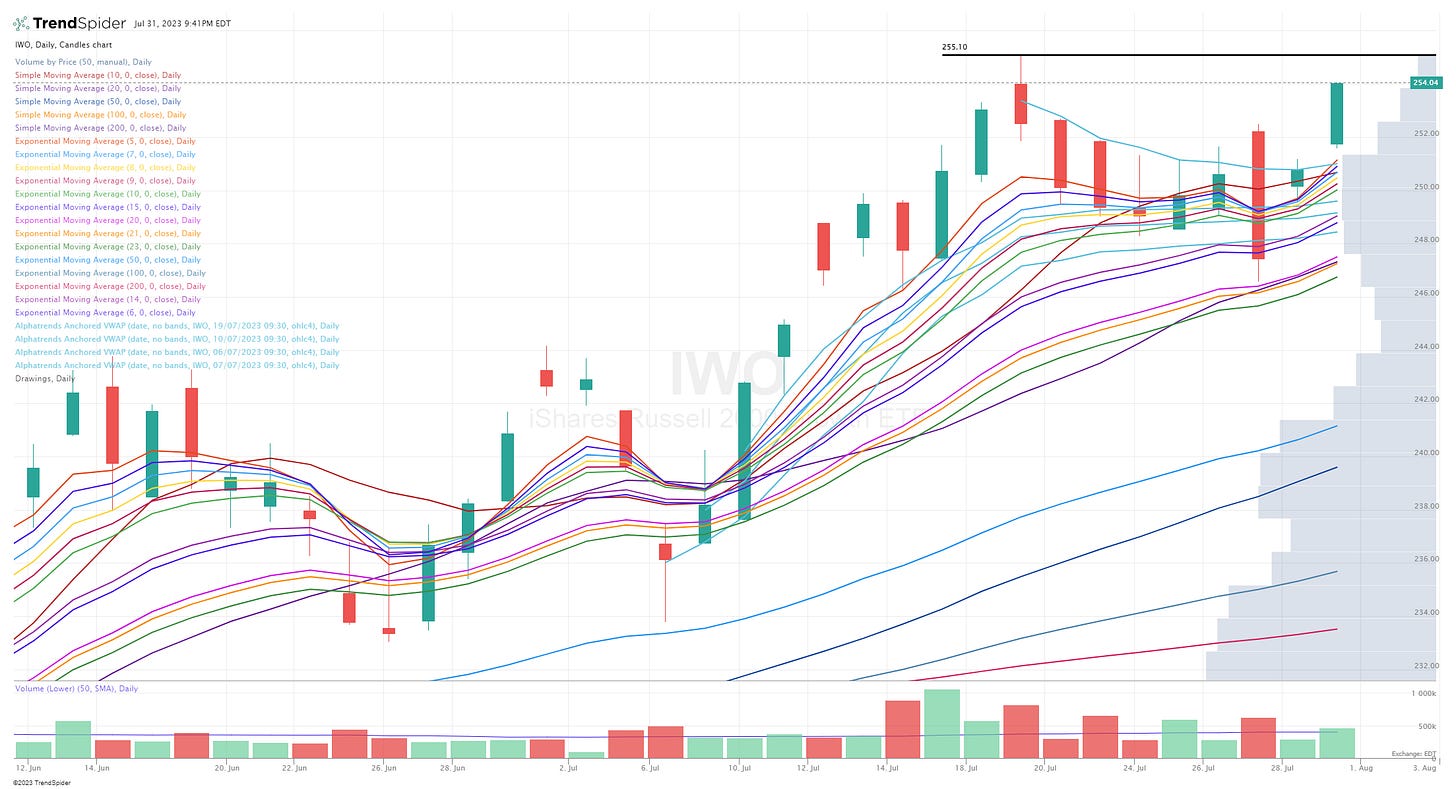

IWO bouncing back strong the past two days after that nasty reversal last Thursday, yesterday was a new YTD closing high for IWO.

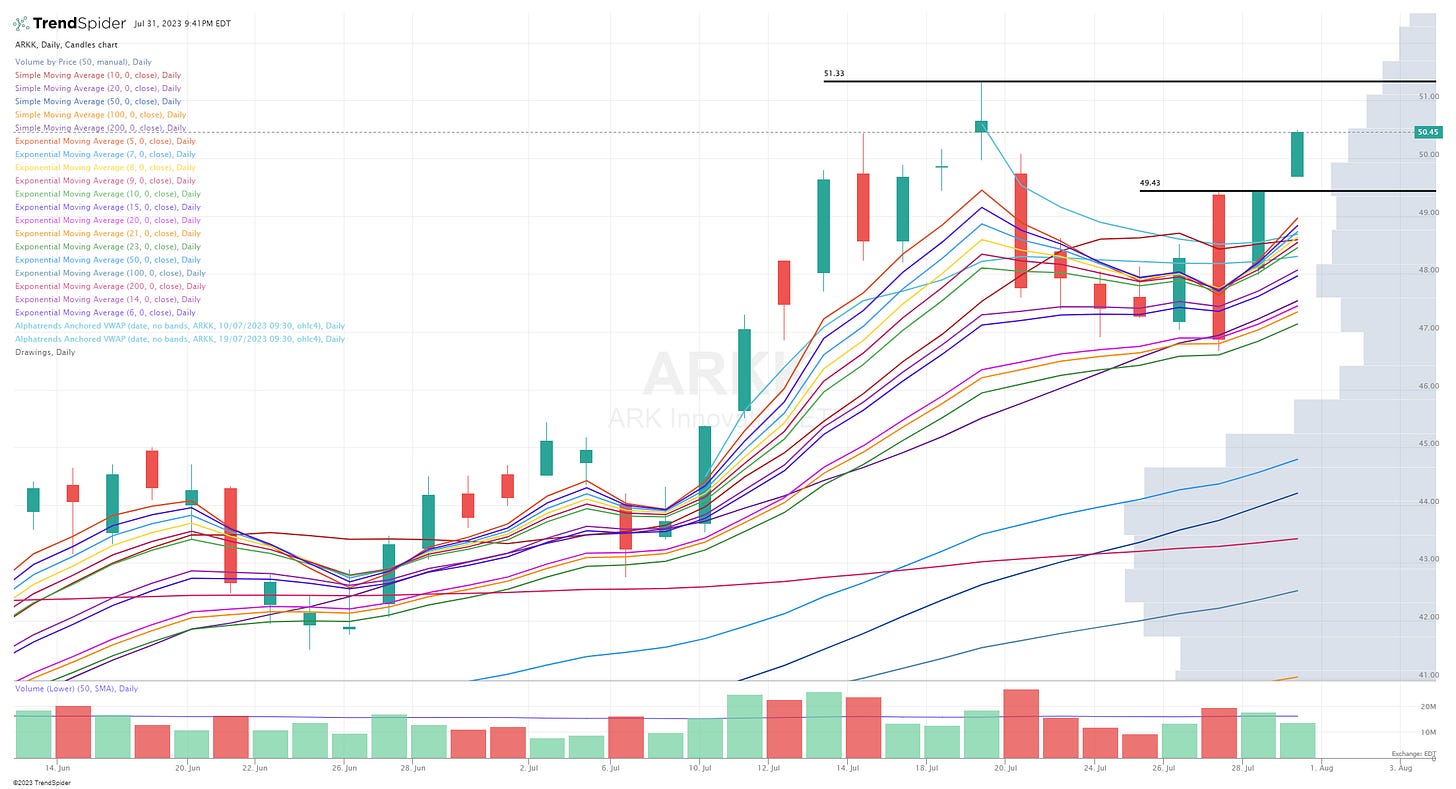

ARKK gapping up above 49.43 and closing near the highs of day.

Below the paywall is my current trading portfolio including all positions (open & closed), entry prices, stop losses and YTD performance plus a link to my daily webcast. If you thinking about becoming a paid subscriber, today is the last day to lock-in the current prices ($20 per month or $200 per year) because tonight they’re going up to $30 per month or $300 per year.