Trading the Charts for Monday, January 8th

In order to read this entire newsletter you’ll need to become a paid subscriber by clicking the button below. Paid subscribers get full access to my trading portfolio (up +97.3% in 2023), daily watchlists with charts, daily activity with entry prices & stop losses, all trading stats with performance, and my daily webcasts.

I also run a Stocktwits room where I post throughout the day about my investment portfolio (up +134.7% in 2023 and +1,064% since January 2020) with full access to my current holdings, performance stats, daily activity, market commentary, quarterly earnings analysis, daily webcasts, investment models and much more.

Here’s my other Substack newsletter if you want my weekly deep dives (8,000+ words) and weekly mini deep dives (2,000+ words)…

Earnings reports for the week…

Macro reports for the week… CPI on Thursday and PPI on Friday are the big ones…

FOMC updates… back to 60% probability or rate cut at March meeting…

Equity futures this morning…

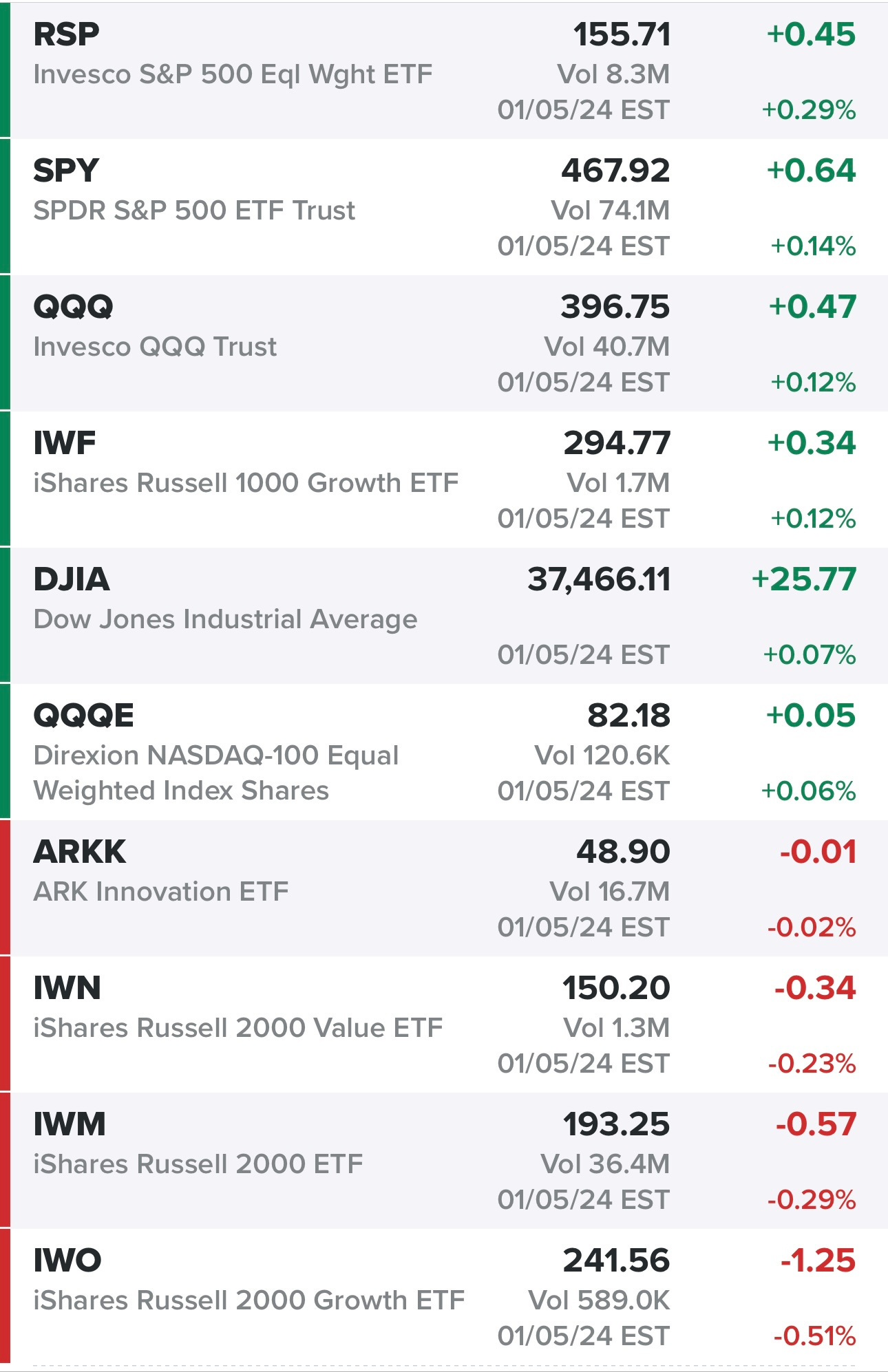

Indexes from Friday…

Sectors from Friday…

Rates this morning…

New highs vs new lows…

Market momentum… not a good sign that utilities looks the best right now but that might just be the defensive posturing coming into 2024 as most stocks sold off, now let’s see if we see a rotation back into growth, small/mid cap and which sector(s) lead us higher

$TNX (10Y Treasury)

$VIX

$CL1! (Oil)

$SPX (S&P 500)

SPY (S&P 500, market cap weighted)

RSP (S&P 500, equal cap weighted)

QQQ (Nasdaq 100, market cap weighted)

QQQE (Nasdaq 100, equal cap weighted)

IWF (Russell 1000 Growth)

IWM (Russell 2000, small/mid caps)

IWO (Russell 2000 Growth, small/mid caps)

ARKK (Ark Innovation ETF)

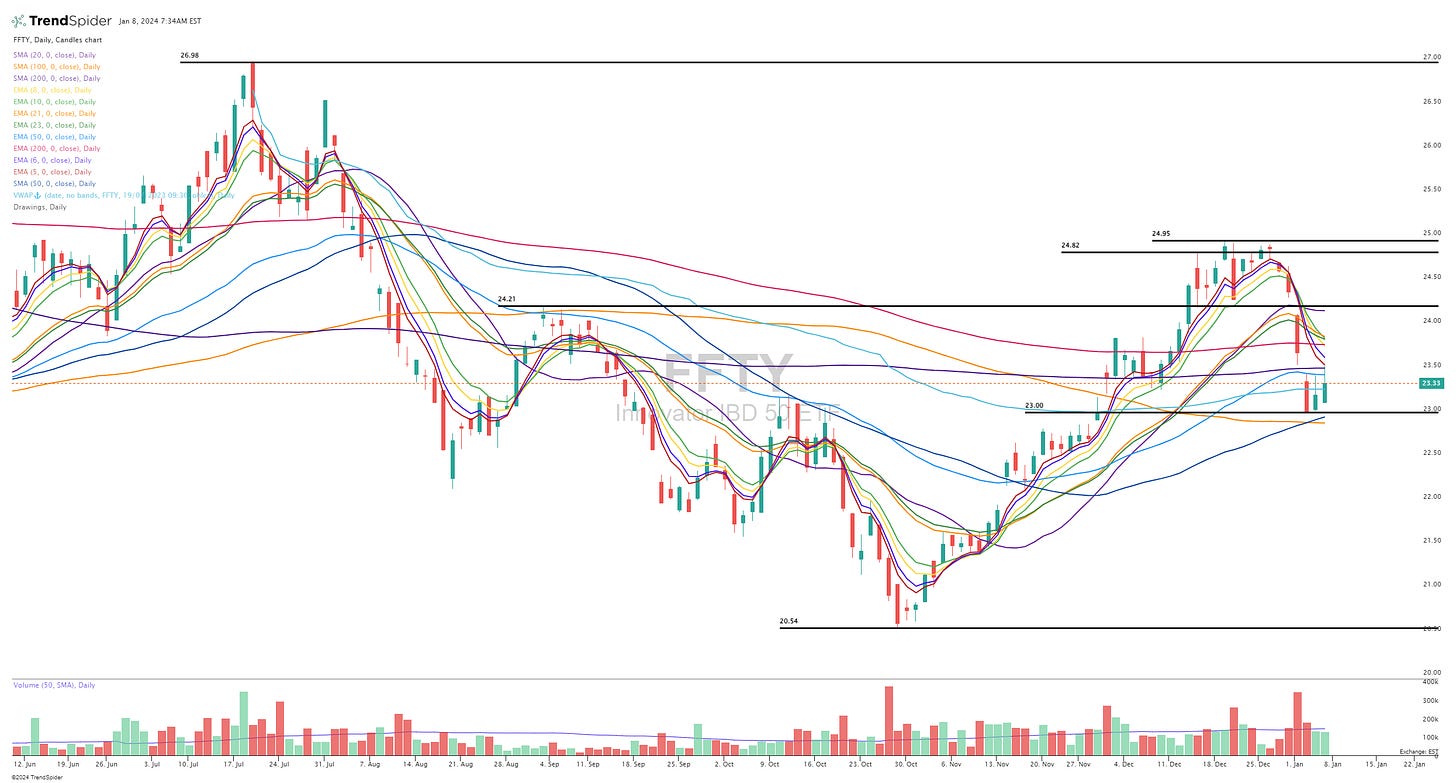

FFTY (IBD Innovator ETF)

Finviz screen #1: ACAD ACIW AFRM ALHC ALKS ALLY APO AROC ASAI ASND ASPN AVDX AXNX AXSM AZEK AZTA BANC BIRK BMRN BRBR BROS CCL CE CELH CIEN CLBT CLSK COTY CP CPRX CRWD CTKB CUK CX CYBR DASH DDOG DHT DLO DXCM EBR EDU ELF EPR EQH ERJ ESMT ESTC EVH FLS FOLD FOUR FROG FRPT FRSH FTAI GENI GGAL GLBE GNTX GS GTLB HBM HDB HIMS HOOD HQY HUBS HWM IMGN IOT ITCI KKR LGF-A LGF-B LLY LSPD LYV MC META MGA MIR MMYT MNDY MRTX MS MU NBIX NCLH NCNO NE NEOG NET NOV NOW NTNX NTRA NTST NU NVDA NVO NXT OKTA OSCR OSW OWL PANW PCOR PDD PGNY PGR POST PR PWR RCL RIVN RKT RNW ROIV ROL ROVR RRX RXST RYAAY RYTM S SBS SFL SHAK SHOP SMAR SNOW SOFI SPOT SPT SQ SQSP STNE TAL TDW TEAM TGI TMDX TREX TRIP TWO TXG U UBS VCYT VIV VOYA VRT VVV WFRD WT XP ZS

Criteria: stock price above $5, market cap above $1 billion, above 50d sma, above 200d sma, average daily volume above 500k, sales growth above 15%, earnings growth above 15%

Below the paywall is my:

morning commentary

daily watchlists with charts

link to current trading portfolio with all positions, entry prices and stop losses

links to my daily webcasts and all previous webcasts

YTD trading stats and performance