Trading the Charts for Tuesday, January 30th

In order to read this entire newsletter you’ll need to become a paid subscriber by clicking the button below. Paid subscribers get full access to my trading portfolio (up +6.8% in 2024, up +97.3% in 2023), daily watchlists with charts, daily activity with entry prices & stop losses, all trading stats with performance, and my daily webcasts.

Here’s my other Substack newsletter called Growth Stock Deep Dives where I provide weekly deep dives (8,000+ words) and weekly mini deep dives (2,000+ words), plus you get access to my investment portfolio (up +27.5% in 2024, up +134.7% in 2023, up +1,180% since January 2020), my daily activity, my daily webcasts, and my investment models.

Earnings reports for the week…

Macro reports for the week…

CPI spreadsheet…

FOMC updates…

Equity futures…

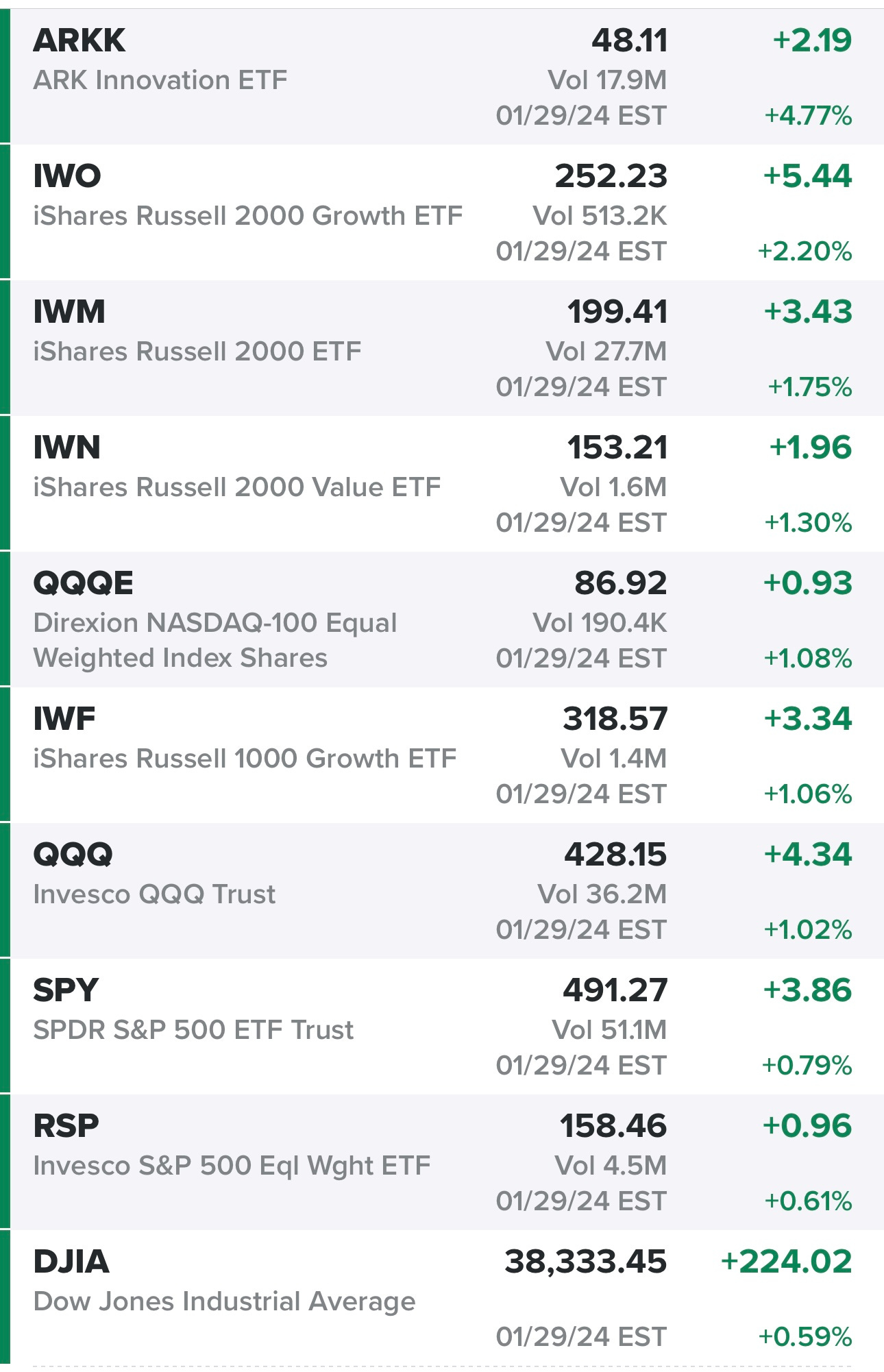

Indexes from yesterday…

Sectors from yesterday…

Rates…

New highs vs new lows…

Market momentum…

$TNX (10Y Treasury)

$VIX

$CL1! (Oil)

$SPX (S&P 500)

SPY (S&P 500, market cap weighted)

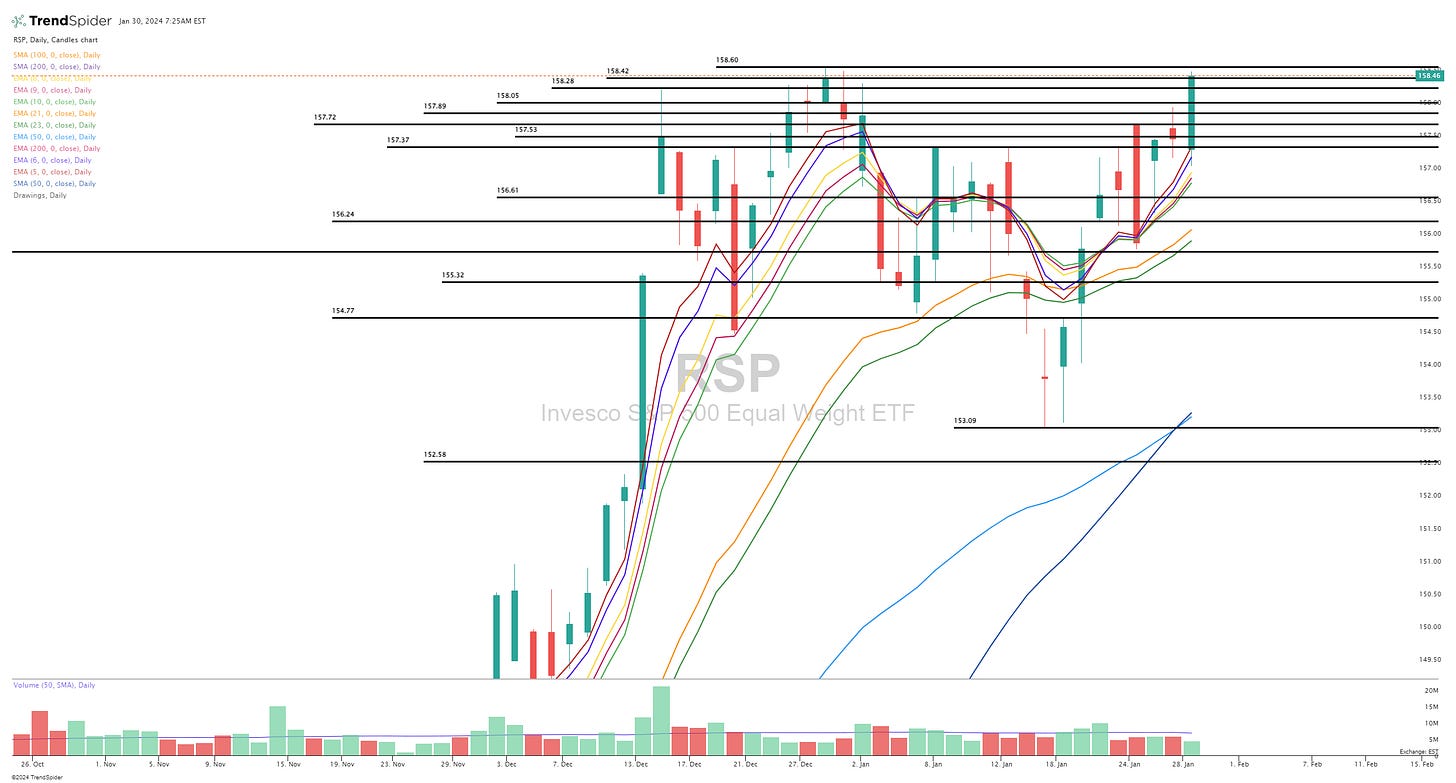

RSP (S&P 500, equal cap weighted)

QQQ (Nasdaq 100, market cap weighted)

QQQE (Nasdaq 100, equal cap weighted)

IWF (Russell 1000 Growth)

IWM (Russell 2000, small/mid caps)

IWO (Russell 2000 Growth, small/mid caps)

IWN (Russell 2000 Value, small/mid caps)

ARKK (Ark Innovation ETF)

IPO (Renaissance IPO ETF)

FFTY (IBD Innovator ETF)

Deepvue screen #1:

Criteria: price above $5, market cap above $1 billion, above 50d sma, above 200d sma, average volume above 400k, YoY sales growth above 20%

Finviz screen #1:

Criteria: stock price above $5, market cap above $1 billion, above 50d sma, above 200d sma, average daily volume above 500k, sales growth above 15%, earnings growth above 15%

Below the paywall is my:

morning commentary

daily watchlists with charts

link to current trading portfolio with all positions, entry prices and stop losses

links to my daily webcasts and all previous webcasts

YTD trading stats and performance